Severance Tax

Background

Colorado’s severance tax was enacted in 1977.1 The severance tax is imposed on the production or extraction of metallic minerals, molybdenum, oil and gas, oil shale, and coal. Taxes are collected by the Department of Revenue. For filing instructions, visit the Colorado Department of Revenue’s severance tax website. Severance tax revenue is subject to the spending and revenue limitations of TABOR.

Tax Credits & Credits

Severance tax rates and credits vary by mineral type as follows:

| Tax Rates | Tax Collection Frequency | Exemptions | Credit/Deductions | |

| Oil and Gas |

Gross income:

|

|

Up to 15 barrels per day (oil) or 90,000 cubic feet per producing day (gas) are exempt (known as the stripper well exemption)

|

Prior to 2024: 87.5% of all property taxes paid except those imposed on equipment and facilities used for production, transportation, and storage 2024 to 2025: 75% of all property taxes paid except those imposed on equipment and facilities used for production, transportation, and storage 2026: 65.625% of gross income times the local property tax rate (mill levy) at the well’s location 2027 and after: 75.56% of gross income times the local property tax rate (mill levy) at the well’s location |

|

Coal

|

Above exemption amount at $1.083 per ton (annual monthly average in 2020) |

|

|

|

|

Metallic Minerals |

2.25% of gross income |

|

First $19 million in gross income is exempt | Property taxes paid capped at 50% of the state severance tax liability |

| Molybdenum | $0.05 per ton |

|

First 625,000 tons are exempt

|

None |

| Oil Shale | 4% of gross proceeds |

|

None | None |

Prepared by Legislative Council Staff.

HB 22-1391 altered the calculation of the severance tax credit for oil and gas production beginning in 2025. Rather than claim a tax credit equal to a percentage of all property taxes paid to local governments on oil and gas production, producers would instead claim a credit equal to a percentage of each oil and gas well’s current year gross income multiplied by the previous year’s mill levy. HB 23-1272 further modified the credit, moving the start of the new calculation to 2026, and reducing the scale of the credit in 2026 to 65.625 percent (75 percent of the assessment rate of 87.5 percent) from 76.56 percent (87.5 percent of the assessment rate of 87.5 percent). In 2027, the credit will increase back to 76.56 percent of current year gross income multiplied by the previous year’s mill levy.

Distribution

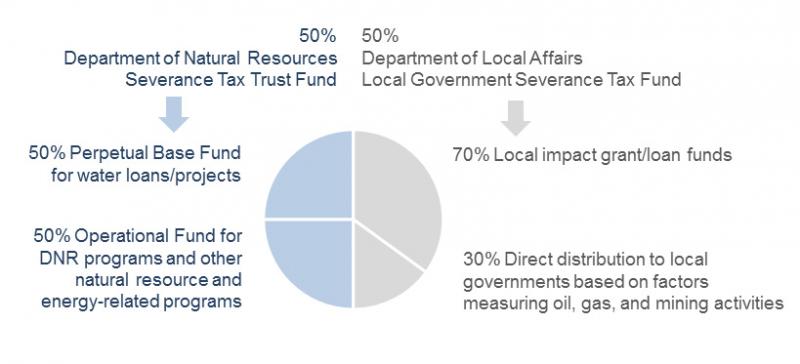

HB 23-1272 modified the allocation of severance tax revenue from FY 2023-24 through FY 2026-27. The bill requires that the additional severance tax revenue collected due to the decrease in the percentage of property taxes that can be claimed as a credit against the severance tax be deposited in the Decarbonization Tax Credits Administration Cash Fund.2 The fund is administered by the Colorado Energy Office and the Department of Revenue for income tax credits that incentivize decarbonization. Remaining revenue will be allocated consistent with historical distributions. The figure below provides a general illustration of how severance tax revenue has been allocated historically, and how all other severance tax revenue is allocated under current law.

Severance tax revenue is divided evenly between the Department of Natural Resources (DNR) and the Department of Local Affairs (DOLA).3 DNR's half is deposited into the Severance Tax Trust Fund, where it is “held in trust as a replacement for depleted natural resources, for the development and conservation of the state's water resources, and for use in funding programs that promote and encourage sound natural resource planning, management, and development related to minerals, energy, geology, and water and for the use in funding programs to reduce the burden of increasing home energy costs on low-income households.”4 Severance tax revenue to the Severance Tax Trust Fund is divided equally between the Severance Tax Perpetual Base Fund and the Severance Tax Operational Fund.

The Perpetual Base Fund is used to finance loans for state water projects administered by the Colorado Water Conservation Board that construct or improve flood control, water supply, hydroelectric energy, and recreational facilities, excluding domestic water treatment and distribution systems.5 The Operational Fund is generally used for programs administered by DNR.6 The fund’s "core" or "tier 1" programs include programs administered by the Colorado Oil and Gas Commission; the Avalanche Information Center; the Colorado Geological Survey; the Division of Reclamation, Mining and Safety; the Colorado Water Conservation Board; and the Division of Parks and Wildlife. In the last several years, money in the Operational Fund has funded other "tier 2" programs, including water and agriculture-related programs, clean energy development, soil conservation, wildlife conservation, invasive species control, and low-income energy assistance.

DOLA's severance tax revenue is credited to the Local Government Severance Tax Fund and distributed to local governments.7 Seventy percent is available for discretionary loans and grants to local governments socially or economically impacted by the mineral extraction industry. Local governments apply to DOLA for the loans and grants at three different times during the year. DOLA is assisted by a 12-member Energy and Mineral Impact Assistance Advisory Committee in making funding decisions. The money must be used for the planning, construction, and maintenance of public facilities, and for the provision of public services. The remaining 30 percent of the money received each fiscal year is distributed directly to local governments by August 31 of the following fiscal year based on the geographic location of energy industry employees, mine and well permits, and overall mineral production.

Federal Taxes

There is no federal severance tax. However, the federal government collects revenue from companies that lease federal land for mineral production. This revenue is called federal mineral leasing revenue (or FML). States receive about half of this revenue. In Colorado, FML revenue is allocated to state agencies, public schools and local governments for planning, construction, and maintenance of public facilities for public services.8

State Comparisons

In total 34 states levy some form of severance tax, including 31 states with a tax on the extraction of oil and gas.9 Taxes are imposed differently across states, where some tax a fraction of the market value of production, others tax the volume produced, and some states tax a combination of both the value of production and amount produced. A 50-state summary of oil and gas severance taxes can be found here.