Cigarette Tax

Background

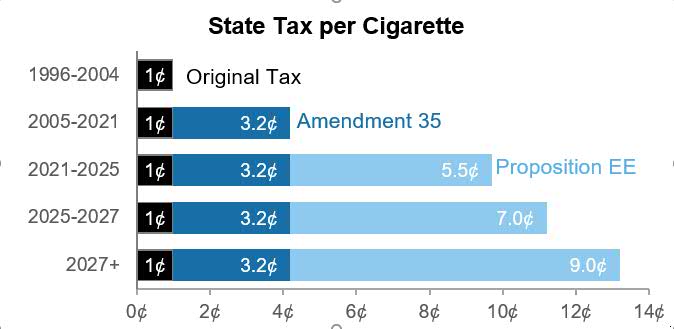

The cigarette tax is levied on the sale of cigarettes by wholesalers and is assessed at a fixed amount on each single cigarette sold. The cigarette tax has three components. The first, enacted in 1964, is a tax of 1¢ per cigarette.1 In 2004, voters approved an additional 3.2¢ tax per cigarette with the passage of Amendment 35. In 2020, voters again approved an additional cigarette tax with the passage of Proposition EE. The additional tax under Proposition EE started at 5.5¢ per cigarette in 2021, and increases incrementally until it is fully phased in at 9¢ per cigarette in FY 2027-28. The Department of Revenue is responsible for administering the three taxes, which are collected in practice as a single tax of $1.94 per pack of 20 cigarettes. Distributors, including out-of-state retailers selling cigarettes online, are responsible for collection of the tax and must submit monthly payments to the Department of Revenue on or before the tenth day of the month following collections. They are entitled to retain 0.4 percent of taxes they collect to cover expenses related to tax collection.

The original 1¢ tax is subject to the TABOR Amendment’s limitations on state revenue and spending, except that the portion distributed to local governments is exempt from TABOR as a collection for another government. Amendment 35 and Proposition EE are voter-approved tax increases, exempting the additional tax revenue from the TABOR limit.

Tax Rate

Cigarettes are taxed at 9.7¢ per cigarette ($1.94 per pack of 20 cigarettes). Cigarettes are also subject to the 2.9 percent state sales tax. Local governments and special districts may also levy a cigarette tax. However, local governments that do so are not entitled to an allocation of state cigarette tax revenue. Since a change in statute in 2019, local governments may impose fees or license requirements on cigarette sellers without losing their share of state cigarette tax revenue. No tax exemptions or credits are available for cigarettes.

Distribution

Revenue from the original 1¢ cigarette tax is credited to the general fund through the Old Age Pension fund,2 27 percent of which is distributed to local governments based on the amount of revenue collected within a given city or county.3 The tax revenue from Amendment 35 is distributed primarily to funds that provide funding for tobacco prevention and health care, as required by the constitution.4 The distribution of revenue from the cigarette tax, tobacco tax, and Amendment 35 (including revenue from both tobacco and cigarettes) is illustrated below.

Proposition EE revenue (including cigarettes, tobacco and nicotine) is distributed to K-12 education, housing, rural schools, and tobacco prevention programs. Starting in 2023, revenue primarily funds preschool programs, in addition to tobacco prevention and health care programs.5

Federal Taxes

The federal government levies an excise tax of 5.03¢ per cigarette, or $1.01 for a pack of 20 cigarettes.

State Comparisons

All states and territories in the U.S. levy excise taxes on cigarettes. Colorado’s tax on cigarettes is above the national average of $1.88 per pack, ranking 28th among the 50 states as of 2023. New York levies the highest state excise tax at $5.35 per pack of 20 cigarettes. Missouri levies the lowest state excise tax at 17¢ per pack.6

At $4.00 per pack of cigarettes, Glenwood Springs, Carbondale, Eagle County, and Summit County have some of the highest local excise taxes on cigarettes in the nation. Similarly, New Castle, Aspen, and Pitkin have local excise taxes on cigarettes that will increase by 10¢ per year until reaching $4.00 per pack.