Alternative Minimum Tax

Background

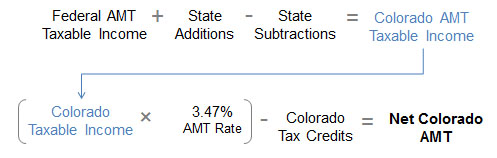

In addition to the 4.40 percent income tax, some Colorado taxpayers with higher taxable incomes are also required to pay a state alternative minimum tax (AMT).1 Individuals, estates, and trusts are subject to the AMT, while corporations are exempt. The AMT is payable only to the extent that it exceeds the regular state income tax. For example, if a taxpayer’s AMT is calculated as $5,000 and their income tax liability is $4,000, they would owe $1,000 in AMT, as well as $4,000 in regular income tax. Taxpayers that owe the Colorado AMT are required to submit the AMT Computation Schedule (104 AMT) with their Colorado individual income tax return (Form 0104) by April 15th each year. If a taxpayer pays estimated tax, this tax must take into account the AMT liabilities that will be incurred in the next year or have been incurred in the prior year.

The Colorado AMT was enacted in 1987. Between tax years 1987 and 2000, the AMT was assessed at a rate of 3.75 percent. Beginning in tax year 2001, the rate was reduced to 3.47 percent. Revenue from the AMT is subject to the revenue and spending limitations of the TABOR Amendment.

Tax Rate

As illustrated in the figure below, the AMT is imposed on federal alternative minimum taxable income at a rate of 3.47 percent, after accounting for allowable Colorado tax modifications (including additions, subtractions, exemptions and deductions).

|

Additions:

|

Subtractions:

|

Tax Credits

See the Colorado corporate and individual income tax sections for information on income tax credits. Additionally, qualifying taxpayers may claim a one-year carry-over of the federal minimum tax credit equal to 12 percent of the prior tax year’s federal minimum tax credit claimed on the current year’s federal income tax return (line 25 on Form 8801). The credit is limited to the net tax liability due for both the Colorado regular income tax and the AMT. Any excess credit cannot be carried forward to another tax year.2

Distribution

Like the individual income tax, one-third of one percent of Colorado taxable income is credited to the State Education Fund, and one-tenth of one percent is credited to the State Affordable Housing Fund. The remaining revenue is credited to the General Fund.3

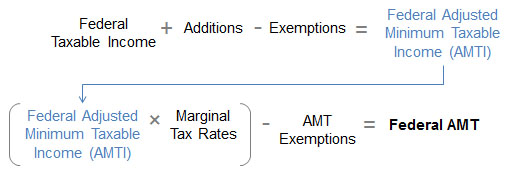

Federal Taxes

Generally, taxpayers with incomes less than $100,000 are not subject to the federal AMT. However, taxpayers must complete Form 6251 (for individuals) to know for sure. See Form 6251 instructions for more information on completing the form. If a taxpayer’s federal AMT is greater than the amount owed on the federal income tax return, the taxpayer is required to pay the AMT. The federal AMT is calculated as follows:

The federal AMT is based on a different taxable income schedule than the regular income tax, where certain income is added back and other income is excluded to calculate the federal alternative minimum taxable income (AMTI). The federal AMT has two marginal tax rates that apply to the AMTI, summarized below with the federal AMT exemption. If the AMT tax liability is greater than the regular federal income tax after subtracting the AMT exemption amount, the regular income tax return amount is required to be paid to the IRS plus the difference between the regular return amount and the AMT. Under the Tax Cuts and Jobs Act of 2017 (TCJA), the AMT exemptions and phaseout amounts are scheduled to be increased annually through 2025.

|

Filing Status and AMTI

|

Tax Rate

|

Filing Status

|

AMT Exemption

|

|

Married, Filing Separately

Up to $103,050

Over $103,050

Any Other Status

Up to $206,100

Over $206,100

|

26%

28%

26%

28%

|

Single

Head of Household

Married, Filing Separately

Married, Filing Jointly

Qualifying Widow(er)

|

$75,900

$75,900

$59,050

$118,100

$118,100

|

State Comparisons

As of tax year 2021, four other states levied a state AMT for individuals, including California, Connecticut, Iowa, and Minnesota. Six states levy a corporate AMT, including California, Connecticut, Kentucky, Minnesota, New Hampshire, and New York.