Severance Tax

Background

Colorado’s severance tax was enacted in 1977.1 The severance tax is imposed on the production or extraction of metallic minerals, molybdenum, oil and gas, oil shale, and coal. Taxes are collected by the Department of Revenue. For filing instructions, visit the Colorado Department of Revenue’s severance tax website. Severance tax revenue is subject to the spending and revenue limitations of TABOR.

Tax Rate

Severance tax rates vary by mineral type as follows:

|

Tax Base

|

Tax Rate

|

|

Coal2

Assessed on the amount

produced per quarter in tons.

|

First 300,000 tons are exempt each quarter

Over 300,000 tons at a rate published monthly by the Department of Revenue

|

|

Metallic Minerals3

Assessed on gross producer

income.

|

First $19 million are exempt

|

| Over $19 million at 2.25% | |

|

Molybdenum4

Assessed on the amount

produced in tons.

|

First 625,000 tons are exempt

|

| Over 625,000 tons at 5¢ per ton | |

|

Oil and Gas5

Assessed on gross income.

Deductions are allowable

for transportation, manufacturing

and processing done prior to sale.6

|

Up to 15 barrels per day (oil) or 90,000 cubic feet per producing day (gas) are exempt

|

|

Under $25,000 at 2%

|

|

|

$25,000 to $99,999 at 3%

|

|

|

$100,000 to $299,999 at 4%

|

|

|

Over $300,000 at 5%

|

|

|

Oil Shale7

Assessed on gross proceeds;

based on years of operation.

Only applicable 180 days after production begins

|

The greater of the first 15,000 tons per day or

the first 10,000 barrels per day are exempt

|

|

First year at 1%

|

|

|

Second year at 2%

|

|

|

Third year at 3%

|

|

|

Fourth year at 4%

|

Tax Credits

Property tax credits are allowed against a company's state severance tax liability by mineral as follows:

|

Tax Credit

|

Credit Amount

|

|

Coal

|

50% of the severance tax liability for coal produced by underground mines and an additional 50% for lignitic coal.8

|

|

Metallic Minerals

|

Property taxes paid capped at 50% of the state severance tax liability.9

|

|

Oil and Gas

|

|

| Prior Payment for Impact Assistance | Value of approved contributions to assist in solving local government severance impact problems.10 |

Additionally, a property tax credit is allowed for contributions to local governments to mitigate social and economic impacts tied to mineral development activities.12

Distribution

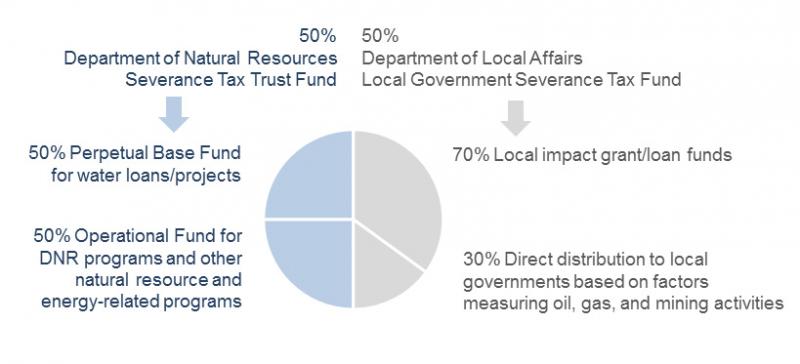

Under current law, the first $1.5 million in severance tax revenue goes to the Innovative Energy Fund. The figure below provides a general illustration of how remaining severance tax revenue is allocated under current law.

Severance tax revenue is divided evenly between the Department of Natural Resources (DNR) and the Department of Local Affairs (DOLA).13 DNR's half is deposited into the Severance Tax Trust Fund, where it is “held in trust as a replacement for depleted natural resources, for the development and conservation of the state's water resources, and for use in funding programs that promote and encourage sound natural resource planning, management, and development related to minerals, energy, geology, and water and for the use in funding programs to reduce the burden of increasing home energy costs on low-income households.”14 Severance tax revenue to the Severance Tax Trust Fund is divided equally between the Severance Tax Perpetual Base Fund and the Severance Tax Operational Fund.

The Perpetual Base Fund is used to finance loans for state water projects administered by the Colorado Water Conservation Board that construct or improve flood control, water supply, hydroelectric energy, and recreational facilities, excluding domestic water treatment and distribution systems.15 The Operational Fund is generally used for programs administered by DNR.16 The fund’s "core" or "tier 1" programs include programs administered by the Colorado Oil and Gas Commission; the Avalanche Information Center; the Colorado Geological Survey; the Division of Reclamation, Mining and Safety; the Colorado Water Conservation Board; and the Division of Parks and Wildlife. In the last several years, money in the Operational Fund has funded other "tier 2" programs, including water and agriculture-related programs, clean energy development, soil conservation, wildlife conservation, invasive species control, and low-income energy assistance.

DOLA's severance tax revenue is credited to the Local Government Severance Tax Fund and distributed to local governments.17 Seventy percent is available for discretionary loans and grants to local governments socially or economically impacted by the mineral extraction industry. Local governments apply to DOLA for the loans and grants at three different times during the year. DOLA is assisted by a 12-member Energy and Mineral Impact Assistance Advisory Committee in making funding decisions. The money must be used for the planning, construction, and maintenance of public facilities, and for the provision of public services. The remaining 30 percent of the money received each fiscal year is distributed directly to local governments by August 31 of the following fiscal year based on the geographic location of energy industry employees, mine and well permits, and overall mineral production.

Federal Taxes

There is no federal severance tax. However, the federal government collects revenue from companies that lease federal land for mineral production. This revenue is called federal mineral leasing revenue (or FML). States receive about half of this revenue. In Colorado, FML revenue is allocated to state agencies, public schools and local governments for planning, construction, and maintenance of public facilities for public services.18

State Comparisons

As of 2012, 36 states levied some form of severance tax, including 31 states with a tax on the extraction of oil and gas.19 Taxes are imposed differently across states, where some tax a fraction of the market value of production, others tax the volume produced, and some states tax a combination of both the value of production and amount produced. A 50-state summary of oil and gas severance taxes can be found here.