Economics Staff prepare General Fund and cash fund revenue forecasts and other forecasts used in the state budgeting process.

Fiscal Notes Staff prepare fiscal analyses of all bills and concurrent resolutions considered by the General Assembly.

The State Auditor and three Deputy State Auditors compose the OSA’s executive management team, known as CSALT (Colorado State Auditor Leadership Team). CSALT is responsible for providing strategic and operational direction for the OSA's performance, financial, and IT auditing activities, including maintaining accountability for all in-house and contract audits, staffing assignments, matters of OSA policy, legislative and agency concerns, personnel issues, and organization-wide initiatives.

Department/Agency |

Topic/Subject |

Report Type |

Expected Release Date** |

| Colleges and Universities | Adams State University, FYE 6/30/2024 | Financial |

Research & Committee Analysts prepare research requested by members of the General Assembly and provide staff support to standing and interim committees. Additional duties include researching and preparing written documents on topics of interest to state legislators, including researching and writing portions of the "Blue Book" voter guide on statewide election issues.

The purpose of the OSA's Fraud Hotline is to receive reports about occupational fraud, a situation in which a state employee or contracted individual (i.e., individual acting under a contract, purchase order, or other similar agreement for the procurement of goods and services with a state agency) may be using their position or access as an employee or contractor to commit fraud against the State or others.

2019 Strategic Plan

2018 Peer Review

2019 Annual Report

In most states, the executive branch initiates the main appropriation bill for the ongoing operations of state government. Colorado, however, has a strong legislative budget process. The General Assembly's permanent fiscal and budget review agency, the Joint Budget Committee (JBC), sponsors the annual appropriations bill (called the "Long Bill") for the operations of state government.

In preparing the budget for the state each year, the General Assembly receives recommendations from its permanent fiscal and budget review agency, the Joint Budget Committee (JBC). The JBC is charged with studying the management, operations, programs, and fiscal needs of the agencies and institutions of Colorado state government. Throughout the year, the JBC holds a number of meetings and considers a range of documents to help prepare the budget recommendations for the General Assembly.

In accordance with Section 2-3-103(2), C.R.S., we publish an annual report that provides an overview of the OSA's activities during the preceding 12 months, as well as information about the OSA's role and mission, the Legislative Audit Committee, and our staff.

State Services Building

1525 Sherman St., 7th Floor

Denver, CO 80203

Call: 303.869.3000

Fax: 303.869.3061

Email: osa.lg@coleg.gov

In accordance with Government Auditing Standards, the OSA undergoes an external peer review every 3 years. The review is conducted by a team of experienced auditors from other state audit organizations and the federal government coordinated by the National State Auditors Association. The purpose of the peer review is to determine if the OSA's system of quality control has been suitably designed and complied with to provide reasonable assurance of conformance with applicable professional standards.

The OSA's Mission

To improve government for the people of Colorado.

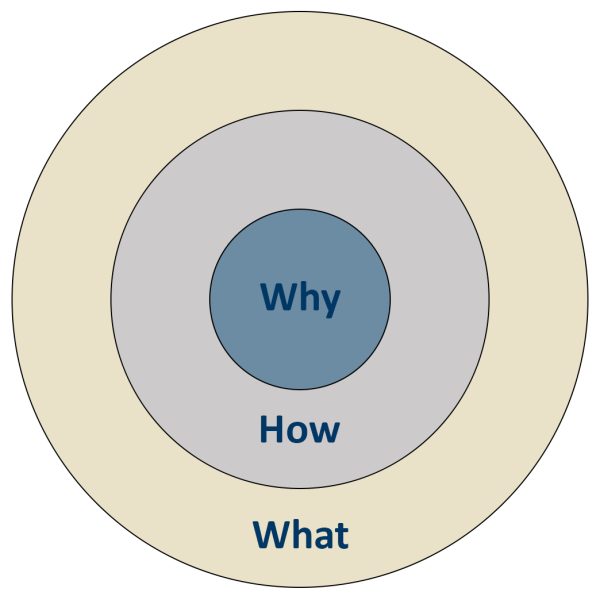

The OSA's Why, How, and What

Why - Accountability for the use of public resources and government authority is essential to Colorado state government and the people it serves.

2016 Digest of Bills

Each year state decision-makers are tasked with balancing constitutional, statutory, and federal requirements with a host of other considerations, such as competing policy priorities, caseload growth, and the health of the state’s economy to create a budget. Although the budget is funded with a variety of revenue sources, state taxes provide a significant portion of the revenue Colorado uses to fund its operations.

Legislative Council Staff is responsible for analyzing the fiscal impact at the school district level of the school finance bill that is introduced during each legislative session.

Legislative Council Staff is responsible for analyzing the fiscal impact at the school district level of the school finance bill that is introduced during each legislative session.

Legislative Council Staff publishes forecasts of the Colorado and U.S. economies and state revenue each March, June, September, and December. The General assembly uses these forecasts to develop the state budget, monitor state spending in relation to revenue, and determine and report the amount of excess state revenue under TABOR.

The Legislative Council Staff prepares memoranda, issue briefs, resource books, and reports addressing topics of interest to members of the Colorado General Assembly and the public. The LCS Staff also has developed several interactive tools for exploring the state economy, tax policy, and the budget.

Legislative Council Staff publications may be accessed by publication type or by subject area below.