Report a Fraud Concern

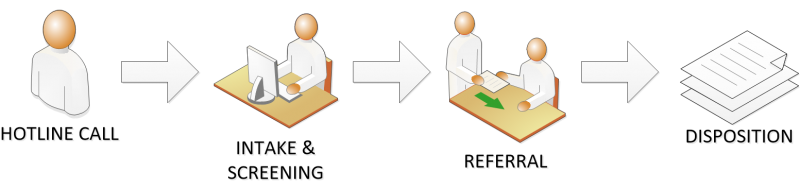

The purpose of the OSA's Fraud Hotline is to receive reports about occupational fraud, a situation in which a state employee or contracted individual (i.e., individual acting under a contract, purchase order, or other similar agreement for the procurement of goods and services with a state agency) may be using their position or access as an employee or contractor to commit fraud against the State or others.

|

Click Here to Submit Your Fraud Concern Online |

You may also contact the Hotline via email or phone:

-

osafraudhotline@coleg.gov

-

303.869.3020