Individual Income Tax

Background

The state of Colorado’s single largest source of revenue, the individual income tax, was enacted in 1937.1 Most individuals and non-corporate businesses are subject to the tax.

In its first fifty years, the state income tax had graduated rates, where higher income earners were subject to higher tax rates than lower income earners. Beginning in tax year 1987, the state legislature simplified the state income tax by enacting a single, or “flat,” tax rate applied universally across all income brackets. Individual income tax revenue is subject to the TABOR Amendment’s limitations on state revenue and spending.

Individual Income Tax Rates since Enactment

Paying Taxes

Individuals and some businesses pay individual income taxes through withholding or through estimated payments. Compensation for employment and earnings from certain other income sources (including pensions, bonuses, commissions, and gambling winnings) are withheld from the employee’s paycheck by his or her employer. For wages and salaries, the amount withheld is determined using Colorado form DR 1098. Withheld taxes are submitted by employers to the Colorado Department of Revenue.

Estimated payments include income for self-employed individuals, as well as income from dividends, interest, capital gains, rent, and royalties. These payments are filed quarterly or annually depending on the type and source of income earned. Estimated tax is used to pay the alternative minimum tax and self-employment tax. Higher income earners may be required to pay the alternative minimum tax (AMT) in addition to the income tax.

Colorado individual income tax returns (Form 0104 and any tax payment owed) for a calendar year are due to the Department of Revenue on or before the following April 15th unless an extension is granted. These forms allow taxpayers to calculate and report how much income tax has already been paid to the state of Colorado through withholding and estimated payments and how much is still due for a given tax year. Taxpayers can consult the Department of Revenue’s filing guide for instructions to complete Colorado Individual Income Tax Form 0104.

Calculating Colorado Income Tax

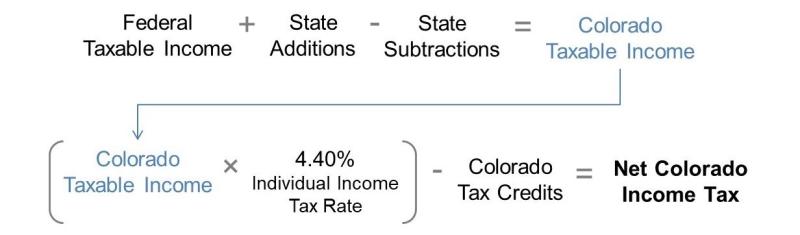

A taxpayer’s Colorado income tax liability is calculated as follows:

Federal taxable income serves as the base for Colorado income tax. Policy that changes federal taxable income will also change Colorado taxable income. To calculate the Colorado income tax, a “flat” tax rate of 4.40 percent is applied to federal taxable income after adjusting for state additions and subtractions, the largest and most common of which are listed below. Colorado income tax credits are then subtracted from this amount to arrive at the net Colorado income tax (the amount paid by a Colorado taxpayer). The Department of Revenue publishes information on income tax expenditures, including subtractions, deductions, and credits, in its biennial Tax Profile and Expenditure Report.

|

Additions:

|

Subtractions:

|

Tax Credits

The table below shows Colorado income tax credits claimed in recent fiscal years. These data generally reflect credits claimed for the tax year in which the fiscal year begins (e.g. FY 2021-22 primarily reflect credits claimed in tax year 2021). Notably, some credits are available for both individual and corporate income taxes.

Most tax credits are nonrefundable, meaning they are limited to the amount of taxes owed. For some nonrefundable tax credits, unused credits may be carried over and used in future tax years. For refundable tax credits, any credits left over after taxed are paid are refunded to the taxpayer.

Distribution

One-third of one percent of state taxable income is credited to the State Education Fund pursuant to the requirements of Amendment 23. This equates to about 8 percent of income tax revenue from both individual and corporate income taxes. Money from the State Education Fund is required to be spent on “accountable education reform, for accountable programs to meet state academic standards, for class size reduction, for expanding technology education, for improving student safety, for expanding the availability of preschool through kindergarten programs, for performance incentives for teachers, for accountability reporting, or for public school building capital construction.”16

One-tenth of one percent of state taxable income is credited to the State Affordable Housing Fund pursuant to Proposition 123, passed by voters in 2022. This equates to about 2 percent of income tax revenue from both individual and corporate income taxes. Money from the State Affordable Housing Fund is designated for affordable housing programs.

The remaining revenue from income tax is credited to the General Fund for spending on general operations.

Tax Checkoffs

See the Colorado income tax checkoffs section.

Federal Taxes

Federal income tax returns are due on April 15 of each year to the IRS unless an extension is granted. Some taxpayers may be required to report other sources of income on separate forms. For example, dividends and interest earnings are reported on 1040 Schedule B. Estimated tax can be reported using Form 1040-ES and must be filed by April 15 of each year, or in quarterly installments by the 15th of April, June, September, and January.

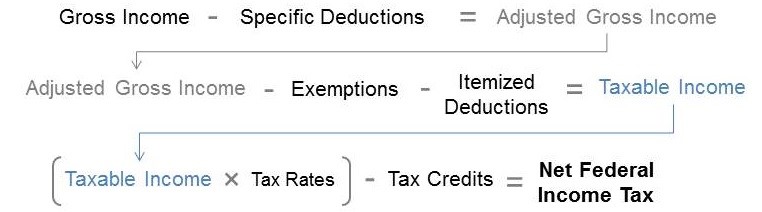

As illustrated below, federal taxable income is calculated as gross income (income from all sources) minus any tax deductions and exemptions for which a taxpayer might qualify. Federal taxable income is multiplied by marginal income tax rates and tax credits are subtracted from this amount to arrive at the net federal income tax (tax owed).

The IRS publishes taxable rate tables each year, which detail how much is owed per filer based on the filer’s taxable income and status (single, married filing jointly, married filing separate, and head of household). In recent years, taxable income brackets have been increased each year, while the tax rates have remained the same. The tables for tax year 2022 are provided below.

Tax Year 2022 Tax Rates by Income and Filing Status

|

Tax Rate

|

For Single Individuals,

Taxable Income Over

|

For Married Individuals Filing

Joint Returns, Taxable Income Over

|

For Heads of Households,

Taxable Income Over

|

|

10%

|

$0

|

$0

|

$0 |

|

12%

|

$10,275

|

$20,550

|

$14,650 |

|

22%

|

$41,775

|

$83,550

|

$55,900 |

|

24%

|

$89,075

|

$178,150

|

$89,050 |

|

32%

|

$170,050

|

$340,100

|

$170,050 |

|

35%

|

$215,950

|

$431,900

|

$215,950 |

| 37% | $539,900 | $647,850 | $539,900 |

| Source: Internal Revenue Service. | |||

For more information on federal income tax credits and deductions, visit the IRS website. For more detailed information regarding federal income taxes, see IRS Publication 17 and IRS Publication 505.

State Comparisons

As of tax year 2023, 11 states have a flat tax, and 30 states and the District of Columbia have a graduated income tax. Two additional states tax only certain types of come at a flat rate, New Hampshire, levies an income tax on only dividends and interest, while Washington taxes only capital gains income. The remaining seven states do not have an income tax. Across the states, flat tax rates range between 2.50 percent (Arizona) and 5.80 percent (Idaho), while marginal tax rates among states with graduated rates range from zero for the lowest income brackets to between 2.9 percent (North Dakota) and 13.3 percent (California) for the highest income brackets. The number of tax brackets range between 3 and 12 across states with graduated tax rates.